April 20, 2022

The global 5G value chain will enable US$13.2 trillion of economic growth by FY35

By FY22, the automotive industry will also require an additional 50% semiconductors due to four-wheelers adapting into compact and automated cars

The government’s ‘Make in India’ and PLI policies for semiconductors are expected to be a game-changer for the space, driving local sourcing further

A report by World Economic Forum suggests that the industry can conduct M&A deals and partnerships in order to narrow the gap and expand its customer base

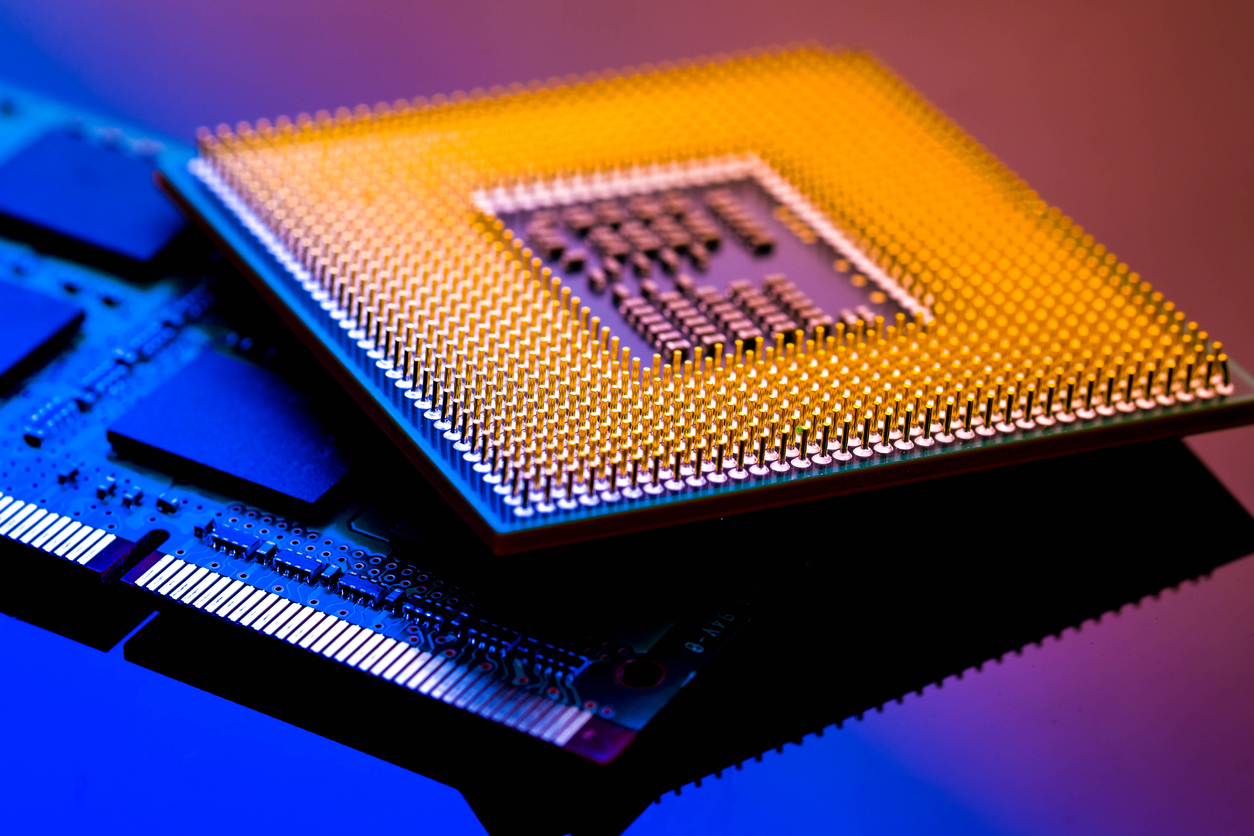

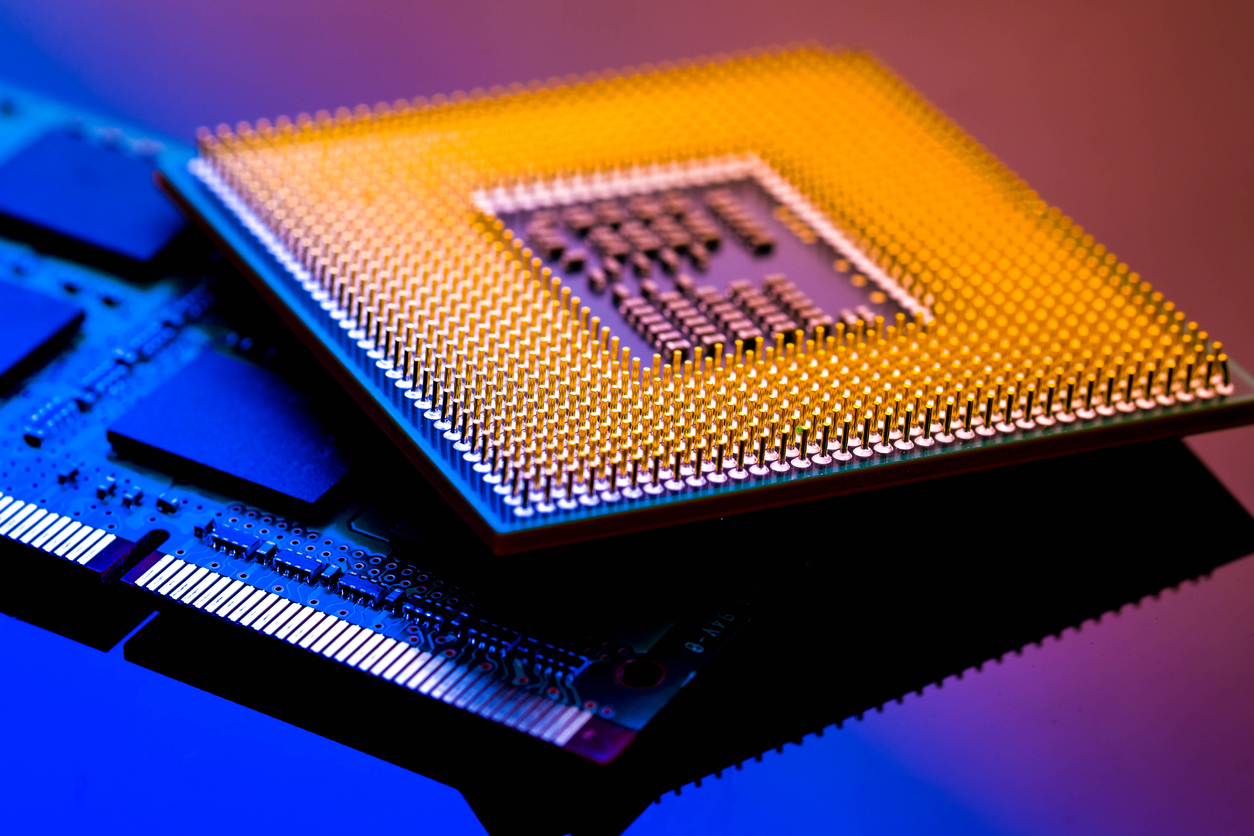

With the advancement of technology, innovations such as 5G, Cloud Data Centres, Internet of Things (IoT), and autonomous vehicles rely on advanced semiconductor technology. A report by IHS Markit also indicates that the global 5G value chain will enable US$13.2 trillion of economic growth by FY35 along with an investment of US$235 billion annually in order to create a robust 5G infrastructure in the country.

Addressing the demand-supply gap

With 5G being introduced in India, setting up the cloud network functionality along with its expansion is evidently to bring about a surge in demand for semiconductors. As stated by a recent Gartner report, by FY22, the automotive industry will also require an additional 50% semiconductors due to four-wheelers adapting into compact and automated cars to ensure sustainability and reliability of the sector in the near future.

In order to bridge this gap, the government has issued a green signal for the Semicon India Programme, along with an outlay of INR 76,000 crore on December 15, 2021, with the view to establish a dynamic semiconductor and display ecosystem in India. Also, the government’s ‘Make in India’ and PLI policies for semiconductors are expected to be a game-changer for the space, driving local sourcing further. With this, local procurement will grow by over 17% by 2026. In FY21, only 9% of India’s semiconductor components were procured locally.

A report by World Economic Forum suggests that the industry can conduct M&A deals and partnerships in order to narrow the gap and expand its customer base. Semiconductor companies can also invest in cutting-edge technologies that can help them increase their production capacity for the advancement of various sectors such as the IoT, Artificial Intelligence (AI), Electric Vehicles (EVs), etc.

Opportunities to explore

According to a report by the Indian Electronics and Semiconductor Association (IESA), the three crucial pillars for the semiconductor ecosystem are sourcing the manufacturing equipment, the materials used and the services across the semiconductor manufacturing value chain. The global opportunities across these elements are projected to be around US$550-600 billion by FY30.

With this, India is destined to emerge as the latest innovation partner and a significant supplier of semiconductor chips in the next 10 years. This also complements India’s goal to reach US$1 trillion in exports by FY30.